IFRS Vs GAAP

Htay Aung (Chris)

What is IFRS?

International Financial Reporting Standards (IFRS) are a set of accounting standards developed by the International Accounting Standards Board (IASB). IFRS aims to provide a common accounting language to enhance transparency, comparability, and consistency of financial statements globally. These standards are widely adopted outside the United States, with more than 140 jurisdictions requiring or permitting IFRS for domestic listed companies.

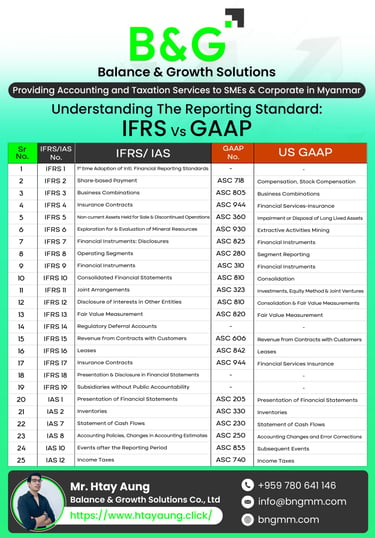

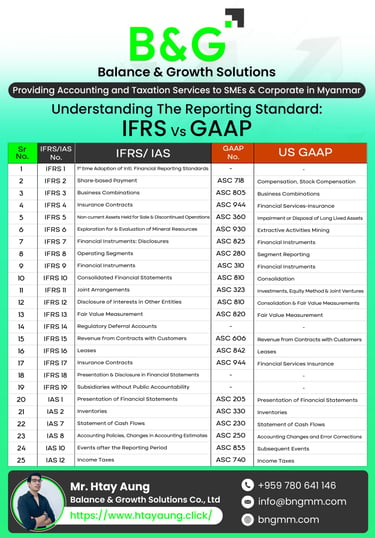

IFRS 1 First-time adoption of International Financial Reporting Standards

IFRS 2 Share-based payment

IFRS 3 Business combinations

IFRS 4 Insurance contracts

IFRS 5 Non-current assets held for sale and discontinued operations

IFRS 6 Exploration for and evaluation of mineral resources

IFRS 7 Financial instruments: disclosures

IFRS 8 Operating segments

IFRS 9 Financial instruments

IFRS 10 Consolidated financial statements

IFRS 11 Joint arrangements

IFRS 12 Disclosure of interests in other entities

IFRS 13 Fair value measurement

IFRS 14 Regulatory deferral accounts

IFRS 15 Revenues from contracts with customers

IFRS 16 Leases

IFRS 17 Insurance Contracts

What is GAAP?

Generally Accepted Accounting Principles (GAAP) are the accounting standards used primarily in the United States. Developed by the Financial Accounting Standards Board (FASB), GAAP encompasses a comprehensive set of rules and guidelines that govern financial reporting. GAAP aims to ensure clarity, consistency, and comparability in the financial statements of businesses operating within the U.S. market.

Principle of Regularity: Ensuring the accountant is adhering to GAAP rules and regulations as standard.

Principle of Consistency: Accountants should keep consistency in applying the same standards in the entire reporting process. This consistency allows financial comparability between periods.

Principle of Continuity: The assumption of business continuing to operate should be there while valuing the assets.

Principle of Sincerity: Accountants should provide an impartial and accurate depiction of the financial situation of the company.

Principle of Non-Compensation: Accountants should maintain transparency and include both positives and negatives. There should not be any expectation for debt compensation.

Principle of Prudence: Financial data representation should be based on facts rather than being mere speculation.

Principle of Permanence of Methods: Financial reporting should involve consistent use of principle to ensure comparability of financial information.

Principle of Periodicity: Entries should be reported across appropriate periods of time.

Principle of Materiality: Accountants are expected to remain transparent and disclose accounting as well as financial data in reports.

Principle of Utmost Good Faith: As the name suggests, the principle expects parties to remain honest in all transactions.

Introduction to IFRS Vs GAAP

In the accountants, two primary standards guide financial reporting:

International Financial Reporting Standards (IFRS)

Generally Accepted Accounting Principles (GAAP)

These frameworks are critical for businesses globally, as they dictate how financial transactions and statements should be recorded and presented.

Accountants understanding the differences between "IFRS Vs GAAP" can significantly impact financial decisions, compliance, and global operations.

Key Differences Between IFRS and GAAP

While both IFRS and GAAP serve the same primary purpose of standardizing financial reporting, several key differences set them apart: